Profit Margin Calculator

Maximise your margins with our free and simple calculator.

Frequently Asked Questions

How to calculate gross profit

Your gross profit margin is the amount of profit you earn after you’ve accounted for the cost of your services or goods, based on how much you sell them for. The formula for gross profit calculation is:

(Revenue – Cost of Goods Sold) / Revenue x 100

The gross margin is beneficial when analysing the profitability of a particular product or service, knowing how much you earn off of the work you do compared to how much it costs to provide the work. This can help you target low margin services and improve their value.

How to calculate net profit

Your net profit margin provides a fuller view of your financial situation, taking into account revenue and COGS, but also accounting for all your business and operating expenses. These can include rent, payroll, utility bills, insurance, tax payments and any advertising. The net profit calculation formula is:

(Total Revenue – Total Costs) / Total Revenue x 100

The net profit is always lower than the gross profit, because it has to account for a lot more cost factors. However, this gives a more detailed indication of your business’ financial situation.

How to maximise profit

We’re glad you asked!

Our blog has a dedicated post which discusses ways for maximising your business profit margins.

Have a read of it here.

Try Mira now, and get your nights back.

We get you. You’re running a small business and doing everything yourself. You don’t have enough time and you’re spending too long every night on paperwork.

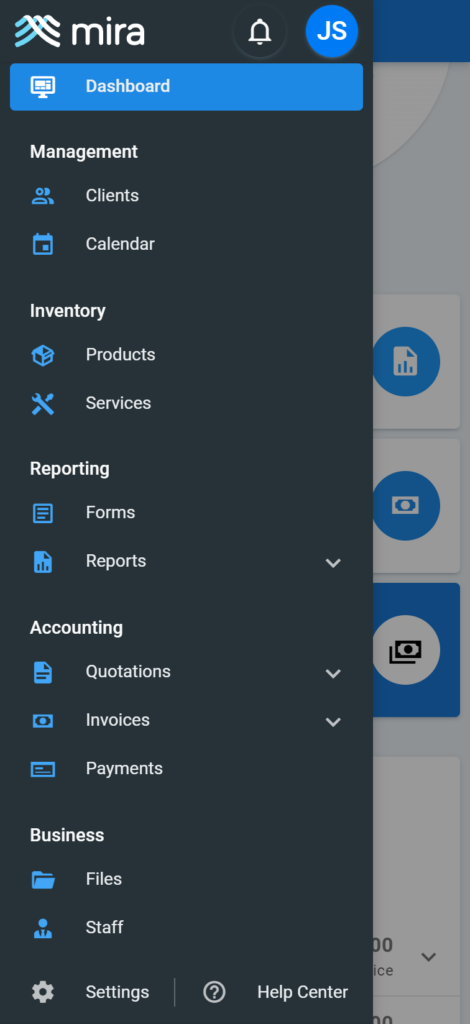

We’re here to help with easy-to-use job management software, packed with features to support your business:

- Save a lot of time on paperwork

- Look more professional to clients

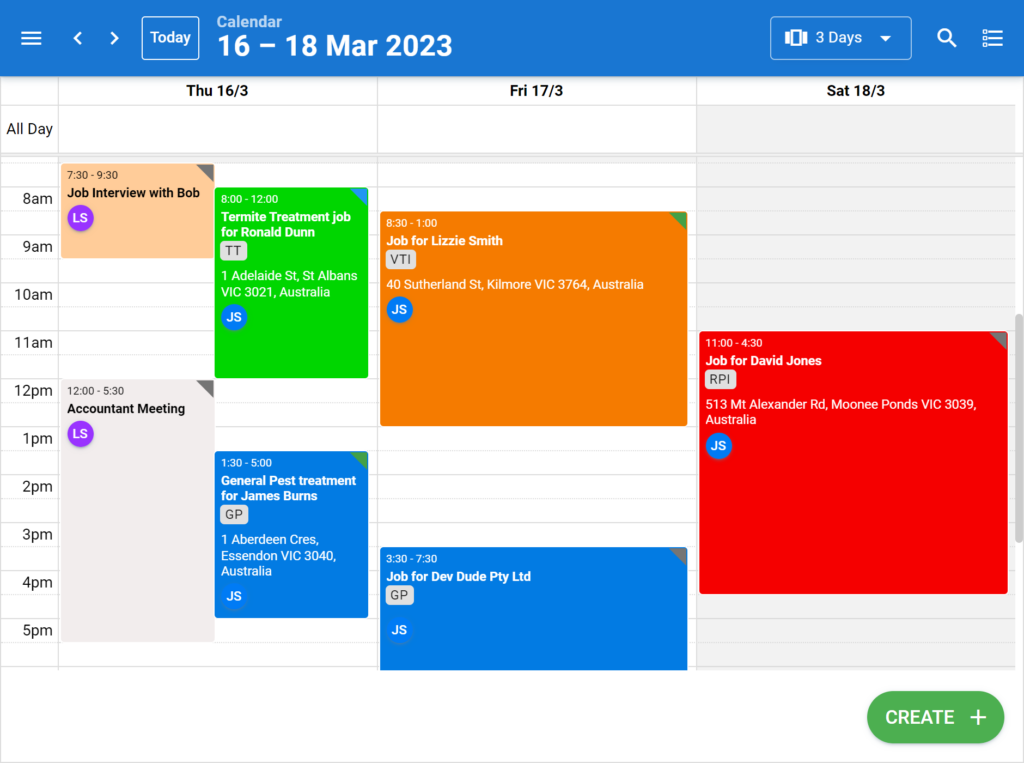

- Keep track of appointments and check you’ve been paid at a glance